The power generation market in China is facing serious challenge due to over investment in new generation capacity – in both renewable and nonrenewable segments.

According to the latest report from Bloomberg New Energy Finance (BNEF), by the end of 2016, the national power market was oversupplied by 35 percent.

China’s power generators, both renewable and coal, experience increasing competition for dispatch.

Renewable power generators face the worst curtailment rates in the world, with the national average curtailment ratio in 2016 at 17% for wind and 10% for solar.

Coal power generators are entering an unprecedented period of uncertainty as regulators tighten environmental regulations and cancel new projects. The estimated value of coal stranded assets comes to around $237 billion, BNEF report says.

Curtailment will decline nationally, but it may emerge in southern provinces: A slowdown in new build, and additions of long-distance transmission lines to export electricity, will play a major role in alleviating the curtailment for northern regions.

The report estimates curtailment to alleviate in the severely curtailed northern regions such as Xinjiang, Gansu and Inner Mongolia. Some non-curtailed provinces might see the issue emerging by 2020, including Hunan, Sichuan, Guizhou and Fujian.

Long distance transmission and power market reforms crucial for reducing renewable curtailment risk: Ultra-High Voltage transmission lines will help alleviate curtailment risks, but the risk mitigation will depend highly on line utilization.

China’s pre-set allocation dispatch mechanism is one of the most critical causes of renewable curtailment. The liberalization of power market will significantly help curtailment alleviation if spot market and ancillary market are successfully established.

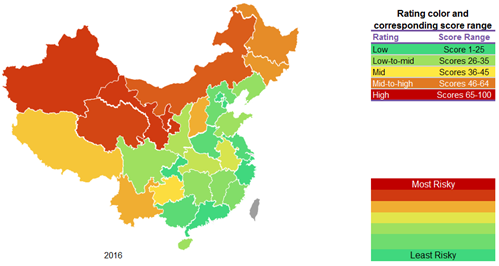

China is still building over 50GW of wind and solar in high curtailment risk regions: The indicators measured in this risk map indicate that over a third of China’s provinces are high risk regions. However, the report finds that there are 30GW of wind and 24GW of solar new build planned for provinces with medium-to-high curtailment risk ratings.

China faces a potential hit of $237 billion from at-risk coal assets: Most recent investment data show that China is still constructing over 120GW of new coal generation capacity. All these plants are high-risky investments, according to the report.

Along with the 195GW of projects that have been cancelled since 2016, and another 100GW of projects awaiting regulatory approval that China still may bring on after 2020, the country faces a social cost of $237 billion from risky coal investments, BNEF report said.