Fitch Ratings has presented a detailed report on India power sector including the status of solar and wind energy price.

The overall coal-fired plant load factor (PLF) in India fell by 2.1pp yoy to 60 percent in the first half of 2017, with the gas-based PLF dropping by 1.9pp to 22 percent.

Fitch Ratings believes that India could actually produce a power surplus in the financial year ending March 2018 (FY18), with an energy deficit of just 0.6 percent in the first three months of FY18 – a period of usually high seasonal electricity demand.

However, sporadic outages continue to plague the country. At the same time, about 24 percent of households are yet to be electrified in India.

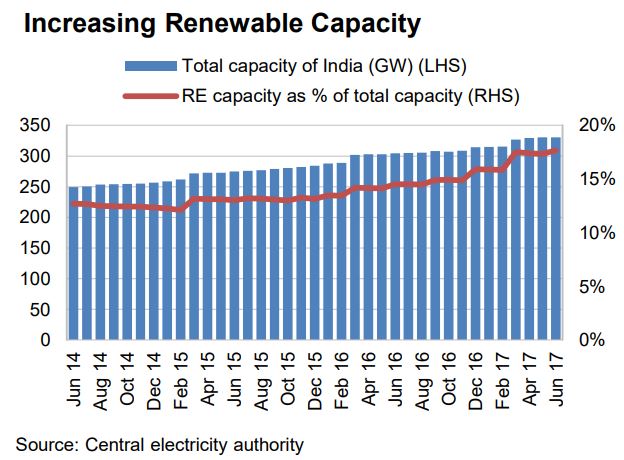

Renewables – Falling Tariffs, Rising Capacity

The new tariff-based auction for wind power yielded prices of INR3.5 / kWh in February 2017, down from the lowest regulatory tariff of INR4.2/kWh. Solar tariffs hit a new low of under INR3 / kWh in May 2017 – making solar the cheapest source of electricity in the country. However, any near-term variations will be driven by changes in Chinese solar module prices. India added 25GW of capacity in FY17, of which 58 percent was renewable – a record-breaking contribution.

Tariffs for Renewables Down Further

Tariffs for Renewables Down Further

Solar tariffs in India fell to the lows of INR2.44 / kWh in May 2017. Future solar tariffs will be subject to extension of fixed tariffs by China and advance orders by developers amid antidumping investigations.

“The result of a second auction for 1GW of wind projects is likely in September after resolution of connectivity issues faced by the bid winners. We expect a further lowering of wind tariffs with the move towards the auction route from fixed tariffs,” said Muralidharan R and Rachna Jain of Fitch Ratings.

Widening Surplus, Lower Electricity Prices at Power Exchanges

Widening Surplus, Lower Electricity Prices at Power Exchanges

A combination of subdued demand growth, consistent capacity additions and relatively better networks is driving a widening surplus at energy exchanges (+22 percent yoy in 1H17). The availability of ample and cheaper spot electricity has also allowed state utilities to hold back on signing new PPAs for wind – along with thermal capacity – until clarity emerges on the preferred auction route.

Electricity Prices, New PPAs under Pressure

Electricity Prices, New PPAs under Pressure

Electricity prices at exchanges in India dropped by 11 percent yoy to INR2.4 / kWh in FY17. Tariffs are taking a hit mainly from the prevailing electricity demand-supply dynamics, lower coal costs and a decline in renewable tariffs. Distribution utilities are shying away from signing new long-term power purchase agreements (PPAs) for both thermal and wind capacity – while awaiting clarity on the auction route for wind power, supported by the availability of cheaper spot electricity.

Private Plants Led Low Thermal Capacity Utilisation

Overall thermal PLF in India fell by 1.9pp yoy to 55 percent, with that of privately owned generation companies (gencos) down 3.7pp to 50 percent, central generation cos’ falling 2.1pp to 66 percent, and state gencos largely stable at 51 percent in 1H17. India’s thermal generation capacity has increased by 4 percent over the last year to 221GW by end-June 2017.

Some Respite from Revival Package, Networking Efforts

AT&C losses in Madhya Pradesh came down by 45bp towards end-1H17 from FY16 levels. However, the situation deteriorated further in Rajasthan and Haryana. Nonetheless, all three states recorded an improvement (average INR0.4/kWh) over the period in terms of cost-revenue gap. About 12,600 circuit kilometres (km) of transmission lines were installed in the country in 1H17, around 30 percent higher than the target.

Growth in Capacity Exceeds Demand, not Needs

The overall coal-fired plant load factor (PLF) in India fell by 2.1pp yoy to 60 percent in the first half of 2017, with the gasbased PLF dropping by 1.9pp to 22 percent. Fitch Ratings believes that India could actually produce a power surplus in the financial year ending March 2018 (FY18), with an energy deficit of just 0.6 percent in the first three months of FY18 – a period of usually high seasonal electricity demand. However, in reality, sporadic outages continue to plague the country. At the same time, about 24 percent of households are yet to be electrified in India.

Addressing Affordability and Accessibility is Key

Fitch feels that the inability of financially stressed power-distribution companies to purchase power, along with the absence of adequate network coverage, exerts significant downward pressure on India’s thermal power utilisation.