Itron has signed an agreement to acquire privately held Comverge by purchasing its parent company, Peak Holding, in a cash transaction valued at approximately $100 million.

Comverge specializes in integrated cloud-based demand response, energy efficiency and customer engagement solutions that enable electric utilities to ensure grid reliability. The portfolio will expand the scope of Itron’s smart grid offerings for the industry.

“The acquisition of Comverge enables Itron to offer a unique solution set that brings Comverge’s demand management solutions to the edge of the network using OpenWay Riva’s edge intelligence and processing capabilities,” said Philip Mezey, Itron’s president and chief executive officer.

“This will enable utilities to better integrate distributed energy resources and optimize grid performance and reliability. With this acquisition, we are delivering even more value for our customers on top of industry-leading AMI and smart grid solutions enabling a robust, active grid,” Mezey added.

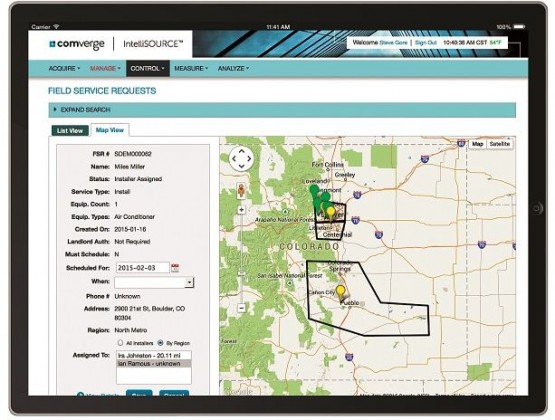

Through its combination of software, hardware and services, Comverge helps utilities optimize every aspect of a demand management program, from participant recruitment and device installation to call center support, control events, and measurement and verification.

Comverge has enrolled and deployed nearly 3 million energy management devices into mass market demand management programs. In 2016, the company generated $60 million in revenue.

“There are tremendous opportunities that exist, between our technologies, operations and customer relationships. The combination of Comverge and Itron is beneficial for both companies and, most importantly, to our employees and customers,” said Gregory Dukat, Comverge’s chairman, president and chief executive officer.

By integrating with Itron’s platform, Comverge creates a more compelling offer that leverages data and analytics to optimize the management of distributed energy resources, delivering even greater customer value, Dukat added.

The transaction is expected to close in the second quarter of 2017, subject to customary closing conditions.